Adidas’ global operations showcase a well-coordinated and efficient production and distribution network, ensuring the brand’s prominence worldwide. The 2023 Annual Report provides detailed insights into their latest strategies and achievements.

Production Overview

Adidas continues to outsource almost 100% of its production to independent manufacturing partners. These partners possess expertise in cost-efficient, high-volume production of footwear, apparel, and accessories and gear. In 2023, Adidas produced 756 million pieces of apparel, footwear, and accessories and gear, down from 1,018 million pieces in 2022, driven by reduced market demand to manage inventory levels.

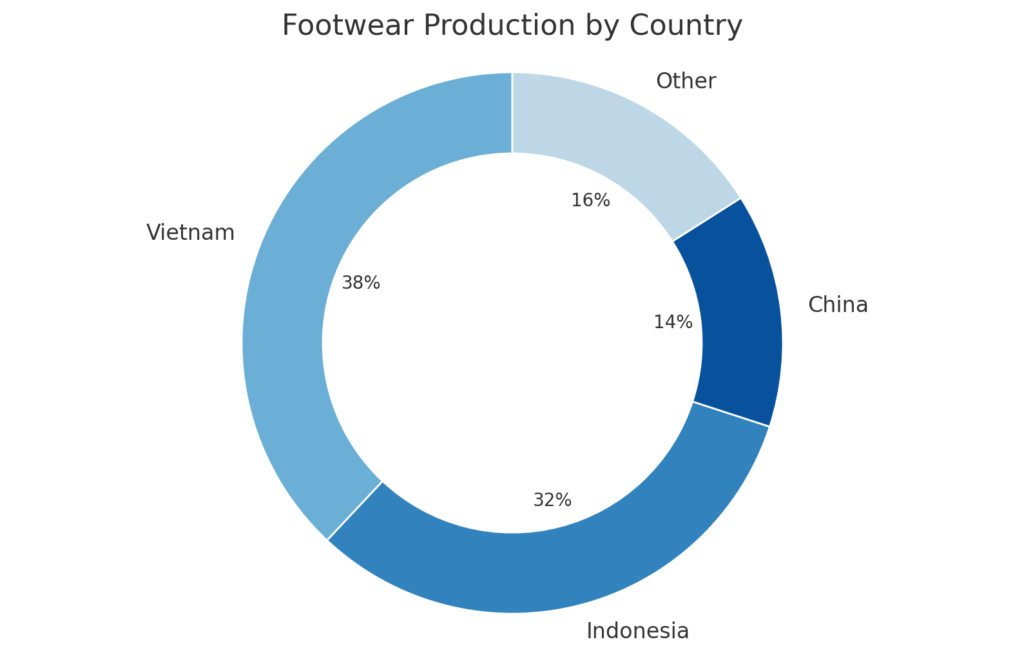

Footwear Production

- Vietnam: Returned as the largest sourcing country, accounting for 38% of total volume (2022: 32%).

- Indonesia: Followed with 32% (2022: 34%).

- China: Accounted for 14% (2022: 16%).

- Asia: 97% of total footwear volume produced in Asia (2022: 97%).

- Total Production: Approximately 311 million pairs of shoes produced in 2023 (2022: 419 million pairs).

- Largest Factory: Produced approximately 8% of the footwear volume (2022: 7%).

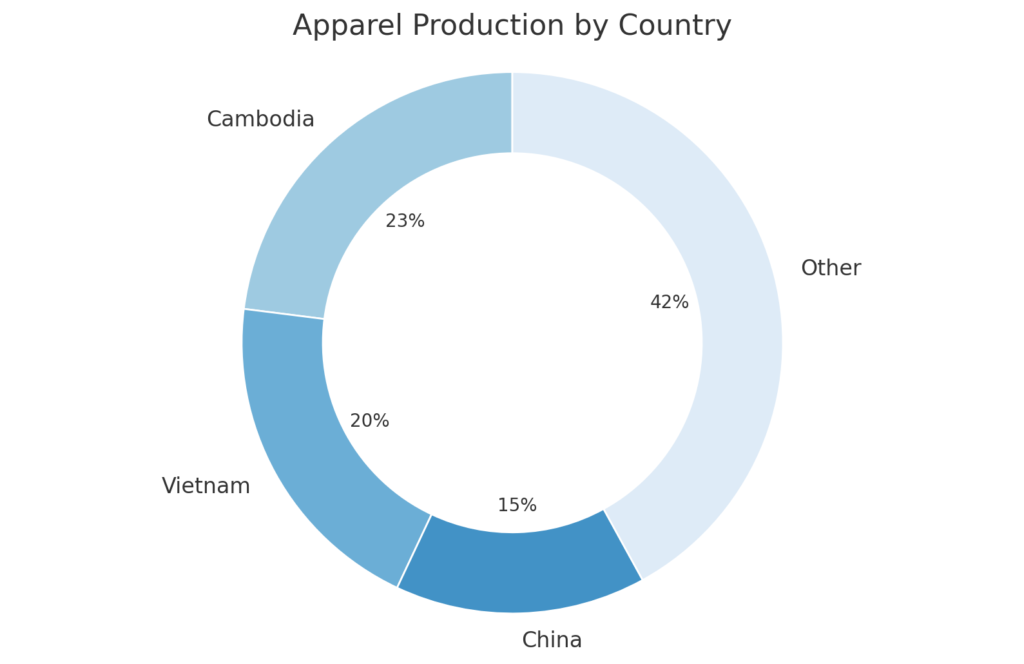

Apparel Production

- Cambodia: The largest sourcing country, representing 23% of the volume (2022: 22%).

- Vietnam: Accounted for 20% (2022: 17%).

- China: Accounted for 15% (2022: 17%).

- Asia: 91% of total apparel volume produced in Asia (2022: 91%).

- Total Production: Approximately 328 million units of apparel produced in 2023 (2022: 482 million units).

- Largest Factory: Produced approximately 10% of the apparel volume (2022: 9%).

Accessories and Gear Production

- Turkey: Became the largest sourcing country, accounting for 26% of the volume (2022: 25%).

- China: Accounted for 22% (2022: 28%).

- Pakistan: Accounted for 22% (2022: 21%).

- Asia: 71% of total accessories and gear volume produced in Asia (2022: 72%).

- Total Production: Approximately 116 million units produced in 2023 (2022: 117 million units).

- Largest Factory: Produced approximately 26% of the accessories and gear volume (2022: 20%).

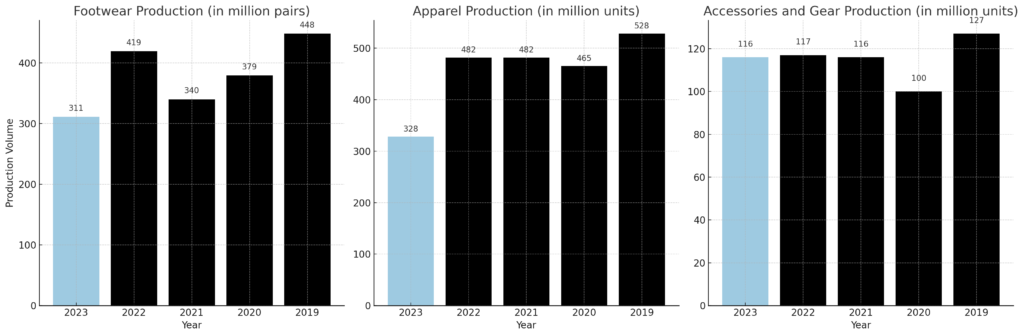

Analysis of Production Volumes by Category (2019-2023)

Footwear Production (in million pairs)

From 2019 to 2023, Adidas’ footwear production has experienced a significant decline. In 2019, the production volume was at its peak with 448 million pairs. However, this number has been steadily decreasing each year. By 2020, the production volume had dropped to 379 million pairs, and it further declined to 340 million pairs in 2021. Despite a slight recovery in 2022, reaching 419 million pairs, the volume dropped again in 2023 to 311 million pairs. This downward trend suggests challenges in the footwear sector, possibly due to market conditions or strategic shifts within the company.

Apparel Production (in million units)

The production of apparel has also shown a declining trend over the past five years. In 2019, Adidas produced 528 million units of apparel, the highest within the period. This volume decreased to 465 million units in 2020 and remained stable at 482 million units for both 2021 and 2022. However, in 2023, there was a notable drop to 328 million units. The consistency in production from 2020 to 2022 suggests that the company managed to maintain stable output despite external challenges, but the significant decrease in 2023 could indicate more profound issues or strategic changes impacting production.

Accessories and Gear Production (in million units)

The accessories and gear category has shown less dramatic fluctuations compared to footwear and apparel. In 2019, the production volume was 127 million units. This figure decreased to 100 million units in 2020 but rebounded slightly in subsequent years, reaching 116 million units in 2021 and 117 million units in 2022. In 2023, production slightly decreased again to 116 million units. The relative stability in this category suggests a more consistent demand or production strategy for accessories and gear compared to the other categories.

Analysis of Market Obstacles Impacting Production Volumes

Several market obstacles likely influenced these production numbers:

2019

Trade Wars and Tariffs

Ongoing trade tensions, particularly between the US and China, increased costs and created uncertainties, which might have led to higher production volumes as companies rushed to produce before potential tariff hikes.

Peak Production

The high numbers in 2019 across all categories reflect a pre-pandemic market with stable supply chains and strong consumer demand.

2020

Pandemic Impact

The COVID-19 pandemic caused significant disruptions in global supply chains, factory shutdowns, and workforce shortages. This is reflected in the noticeable drop in production across all categories, with footwear production decreasing from 448 million pairs in 2019 to 379 million pairs in 2020, apparel from 528 million units to 465 million units, and accessories from 127 million units to 100 million units.

Economic Downturn

The economic recession triggered by the pandemic reduced consumer spending, impacting demand.

2021

Ongoing Supply Chain Disruptions

Continued effects of the pandemic, including shipping delays and container shortages, impacted production volumes. Despite these challenges, apparel and accessories production remained stable, likely due to adjustments and resilience strategies implemented by Adidas.

Market Competition and Consumer Shifts

Changes in consumer behavior and increased competition might have influenced production strategies, especially in footwear which saw a decline to 340 million pairs.

2022

Recovery Efforts

As global economies began to recover, there was a slight rebound in production volumes. Footwear production increased to 419 million pairs, indicating partial recovery from pandemic-related disruptions.

Sustainability and Ethical Production

Growing consumer demand for sustainable and ethically produced goods might have influenced Adidas to adjust its production processes, impacting overall volumes.

2023

Strategic Shifts and Market Adjustments

The significant drop in production volumes in 2023 across all categories (footwear to 311 million pairs, apparel to 328 million units, accessories to 116 million units) could indicate strategic shifts within the company. This includes potential restructuring, cost-cutting measures, or a focus on higher-margin products.

Ongoing Economic Challenges

Continued economic uncertainties, inflation, and possibly the lingering effects of supply chain disruptions may have further impacted production.

Relationships with Independent Manufacturing Partners

Adidas maintains strong relationships with its independent manufacturing partners to ensure high-quality production and efficiency. In 2023, Adidas worked with 104 independent manufacturing partners, down from 117 in 2022. These partners operated in 237 manufacturing facilities, compared to 259 in 2022. Notably, 78% of these partners are located in Asia, up from 71% in 2022.

Long-Term Relationships

74% of partners have worked with Adidas for at least ten years, and 38% for more than twenty years.

| Relationship Duration | Total | Footwear | Apparel | Accessories and Gear |

|---|---|---|---|---|

| Average years | 20.8 | 22.5 | 20.0 | 20.8 |

| < 10 years | 26% | 33% | 22% | 31% |

| 10 – 20 years | 36% | 25% | 40% | 31% |

| > 20 years | 38% | 42% | 38% | 38% |

All manufacturing partners are subject to strict performance criteria, regularly measured and reviewed by Global Operations to ensure the high quality expected from Adidas products. The effectiveness of product-related standards is constantly measured through quality and material claim procedures. Delivery and efficiency performance of partners are tracked, and adherence to social and environmental standards is promoted throughout the supply chain.

Distribution Network

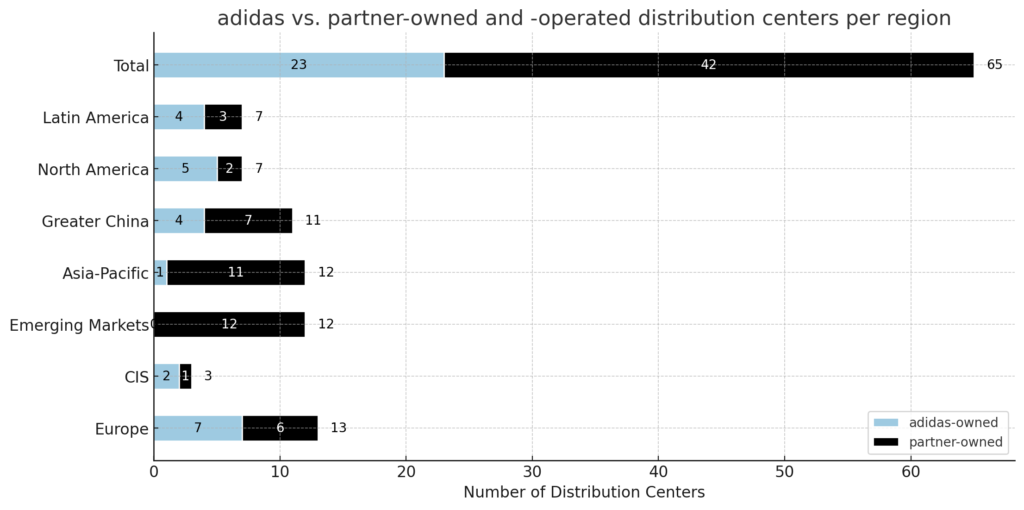

Adidas’ global distribution network is designed for maximum efficiency and flexibility. Of the 65 distribution centers that make up the network, 23 are owned and operated by Adidas, while 42 are owned and operated by logistics partners. This arrangement allows for operational flexibility and agility to best serve customers and consumers.

- Total Distribution Centers: 65 distribution centers worldwide.

- Owned and Operated by Adidas: 23 centers.

- Owned and Operated by Logistics Partners: 42 centers.

- Distribution Center Setup:

- Multi-Channel: 34 centers serve all channels.

- Channel-Specific: 31 centers have a channel- or service-specific setup.

- Returns Facility: Includes a dedicated returns facility to enhance the consumer experience and increase overall network efficiency.

This diverse combination of distribution centers allows Adidas to be agile and efficient in distributing products worldwide.

Financial Performance

Adidas reported a revenue of €22 billion in 2023, marking a 5% increase from the previous year. Significant growth in key markets, particularly in Asia and North America, contributed to this rise.

Sustainability Efforts

Adidas is committed to sustainable practices, aiming for eco-friendly production and reducing its carbon footprint.

- New Initiatives: Launched several new sustainability initiatives in 2023, including increased use of recycled materials and a commitment to carbon neutrality by 2025.

- Progress: Achieved a 20% reduction in its carbon footprint compared to 2020 levels.

Conclusion

The 2023 Annual Report highlights Adidas’ ongoing commitment to innovation, efficiency, and sustainability. By continually improving their production and distribution processes, Adidas maintains its position as a global leader in sportswear.

Sources: